New Employee Retention Tax Credit Info For Restaurants

This applies to the ERC. It means that the tax deduction for qualified wages equaling the ERC is not applicable. Payroll tax deductions are reduced by the FICA credit. The March 2020 ERTC legislation allowed employers to make up to $5,000 per employee and up up to $7,000 per employee eligible for the 2020 program. employee for each calendar quarter in 2021.

- The National Law Review is an online database that contains legal and business articles. It is free to use and requires no login.

- Originally, an employer would first determine if an employee was eligible. Then, they would subtract the ERC from their payroll tax deposit and estimate the ERC for that period.

- The ERC is designed to aid restaurants that experienced either a significant decline in gross receipts or a full or partial suspension of operations due to a governmental order.

- For 2021, the ERC allowed for a higher percentage of qualified wage earners.

- Protect your 4th quarter federal income taxes payments deferred from any penalties or interest

Bars, nightclubs and any other drinking establishments are eligible. The program recognizes that businesses may be in financial distress and offers a fast-track option to those who wish to claim the credit prior the end of the tax year. Qualified businesses can still claim the credit in their 2021 New York state taxes returns.

Are You Eligible To Receive The Credit?

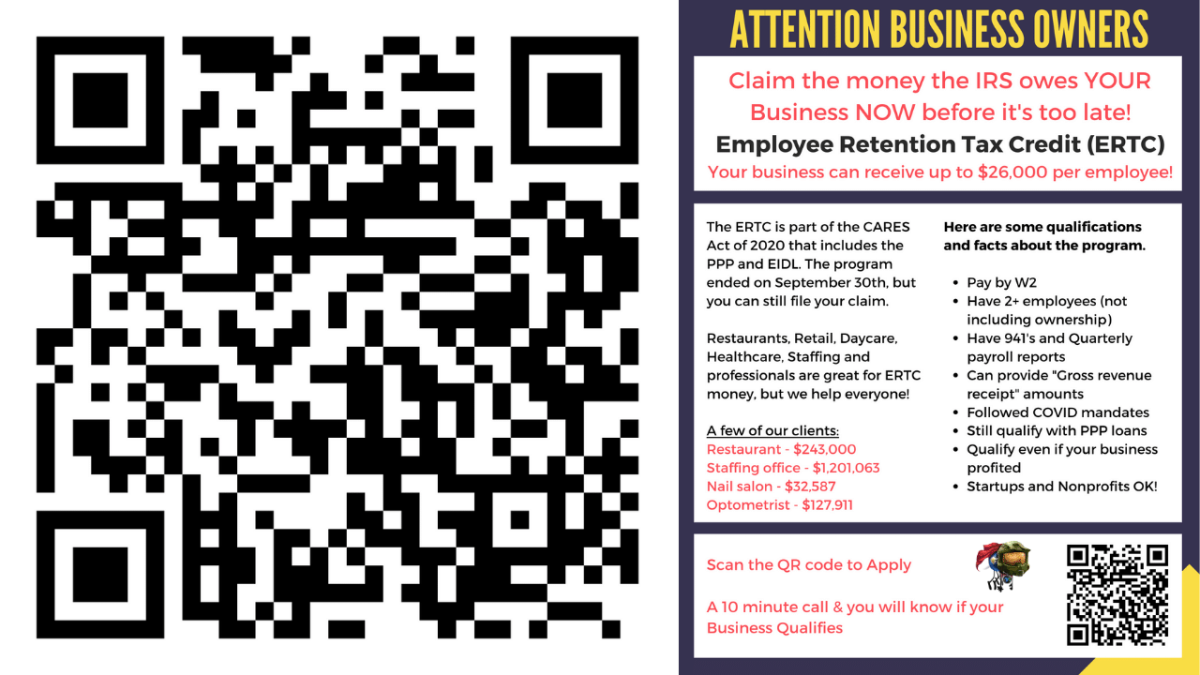

The Employee Retention Credit (“ERC”) was launched in March 2020 to encourage businesses to keep employees on their payroll. It is one of the most significant tax credits that hotels and restaurants can get today for financial hardships caused by the COVID-19 epidemic. Restaurant industry employs a large percentage of part-time employees so it is important employee retention credit 941x example to confirm FTEs are used rather than FTEEs when determining large employers status. Part-time employees will be excluded from the computation for large employers. This will result in fewer restaurants with 500 FTEs or less and more restaurants that can claim the ERC on all wages paid to employees in 2021. Eligibility for employee retention credit for restaurants can be earned in two ways.

This could mean that total payroll costs can drop as high as $5000 per year. Restaurant and hotel managers should look into their eligibility for ERC. Due to the substantial number of government orders limiting the normal activities in 2020 and 2021, many organizations are receiving substantial cash benefits, in addition to PPP benefits already received. Cherry Bekaert has a brochure on Employee Retention Credit that provides more information. If a restaurant/food-service business receives an invitation to apply for the tax credit, certain documentation must be submitted with an application to be considered complete.

Restaurants Will Pay Erc

If they are greater than $20 per month, tips are included in qualified wages and are subject to FICA. Although the government has created many relief programmes for small businesses that employee retention credit are very helpful, it is not enough to keep the best business people in their heads. The ERC has seen an increase in qualified wages for 2021. You must also review aggregation rules since all entities that are treated as a single employer under the Internal Revenue Code are considered one employer for purposes of the ERC.

What is the Employee Retention Credit (ERC)

How to Apply for the ERC Tax Credit

Employee Retention Credit Qualifications

Employee Retention Credit Restaurants

https://vimeopro.com/cryptoeducation/employee-retention-tax-credit-for-restaurants-and-hotels/

https://vimeopro.com/cryptoeducation/employee-retention-tax-credit-for-restaurants-and-hotels/video/770943457/

https://vimeopro.com/cryptoeducation/employee-retention-tax-credit-for-restaurants-and-hotels/video/771209739/

https://howtobuyahouse460.blogspot.com/

https://howtobuyahouse460.blogspot.com/2022/11/how-to-buy-house.html

https://marvinmosley.tumblr.com/

https://marvinmosley.tumblr.com/rss

https://howdoicreateasmartgoaltemplat.blogspot.com/